Menu

As the venture capital arm of Pasargad Financial Group, Shenasa is pleased to announce its 12th year of innovation and technology investment in Iran. With a clearer vision of its investment areas, Shenasa is outlining its goals to provide more transparency about the current investment landscape, investment amounts, and key performance indicators to its stakeholders.

Shenasa, the venture capital arm of Pasargad Financial Group, is entering its 12th year of supporting Iran’s innovation ecosystem. Today, we’re unveiling a more defined investment strategy and sharing insights into our current focus, investment size, and key metrics.

With over 170 investments in the past 12 years, Shenasa has demonstrated its commitment to realizing Pasargad Financial Group’s innovative values and empowering the founders who are driving Iran’s startup ecosystem.

With the strong backing of Pasargad Financial Group, Shenasa is poised to take even bigger and bolder steps in venture capital.

An Investment Policy Statement (IPS) is a document prepared by investment portfolio management that outlines general guidelines. This statement presents overall investment approaches and considerations and explains the strategies that an organization should employ to achieve these objectives. Providing an IPS is a standard method for portfolio management that defines the general operational guidelines for various organizational components and outlines the specific processes that should be followed by executive managers to identify investments that best achieve the program’s goals and align the organization with its strategic plan.

This document specifies the expected investment objectives of the program, determines the focus of the program’s investments, standards, and limitations, and outlines the mechanisms and initiatives that the organization considers to cover potential risks and losses.

This statement, on the one hand, guides the organization’s upstream investors in allocating resources and, on the other hand, guides investable businesses in requesting investments in a targeted and planned manner. Providing this document also enables external stakeholders to leverage the opportunities and capacities within it for greater synergy.

To achieve the above objectives, the components of the investment policy statement may vary based on the conditions and needs of different organizations. However, what is found in most cases is the answer to several fundamental questions regarding the volume, subject, stage, and geographical scope of the investment. In this document, the main headings of the documents presented and the official notes published by various investors, including OHIO LSL, Seraf Compass, Drive Capital, ACT Venture Partners, etc., have been customized based on Shenasa’s conditions and the requirements of its stakeholders and are presented.

Venture capital seeks out profitable investments; therefore, the input and filters based on it are aimed at separating promising businesses from the average. Businesses that can compensate for the failed investments of the entire investment portfolio and its overhead costs in equations known as VC mathematics (achieving an 11-fold value in a few select investments).

Therefore, when examining a venture capital portfolio, it is important to consider that the vast majority of value returns are created by a very small number of companies in the portfolio. This requirement has two very important implications for the daily activities of a venture capitalist:

Among the most important features of the businesses that Shenasa is interested in interacting with, the following can be mentioned:

Shenasa does not seek to invest in foreign startups;

If a business is in the value chain of the financial group, the investment is made with the aim of merging and acquiring competing businesses;

The subject of the business’s activity should not have a direct and harmful legal prohibition in accordance with the laws and regulations of the country;

Businesses that have a minimum viable product (MVP);

The key individuals of the business have a specific and Iranian identity;

Shenasa prioritizes businesses with Iranian founders. In this regard, the presence of the team or its market activity is not limited to Iran;

In its international activities, Shenasa seeks to empower the businesses in its portfolio to enter international markets. However, Shenasa emphasizes the predominance of Iranian identity in the key individuals of the business or the location of the startup’s main operations within the country.

Investment in businesses that are in direct competition with other businesses of the Pasargad Financial Group is done in interaction with its stakeholders;

Co-investment in large sizes, in order to reduce the investment risk with partners who have a specific added value for the business and are willing to accept responsibility and play a role in the growth of the business, is done within a clear and specific framework.

Investing in businesses that are in direct competition with other businesses in Shenasa’s portfolio is done consciously and with a specific purpose;

It has passed the market test phase and is in the product-market fit stage;

Businesses with the capacity that are in the pre-market test phase, with the opinion of the investment committee, can be referred to the accelerator.

With its experience in investment, management, and exit in the areas of health, lifestyle, and technology development, as well as several co-investments with various players in Iran’s innovation ecosystem, Shenasa will prioritize three indicators for its future investment areas in the coming years:

Synergy with some of the industrial players of the Pasargad Financial Group at the beginning or continuation of the startup development path;

Entering areas where the management and resolution of one of the country’s problems is entrusted to the Pasargad Financial Group;

Investing in businesses that have good revenue and their growth for profit sharing until a certain time.

With these considerations, Shenasa’s investment in the fields of information and communication technology, health, banking and financial innovation, mining, energy, and food security will continue to create value in the current and future value chain of the financial group in the coming years. It is worth noting that areas with sufficient and appropriate big data for data-driven venture capital investment have higher attractiveness due to emphasized international trends.

Given the company’s actions and plans, Shenasa’s investment activities are generally carried out through the following approaches:

Shenasa currently focuses on growth-stage investments in tech-enabled businesses and innovative startups. This strategy targets companies that have already validated their market, product, and services, and are poised for significant expansion. This approach, which has led to investments in numerous prominent startups within the ecosystem over recent years, is now maturing.

Under this model, Shenasa provides growth capital in exchange for equity, aiming for an 8-12x return on investment through various exit strategies. Investments are driven by both financial returns and the goal of complementing the value chain of the Pasargad Financial Group.

Shenasa typically invests up to the equivalent of USD 1 million per deal, aligning with global industry benchmarks. Larger investments may be considered on an exceptional basis, preferably in partnership with strategic co-investors to capitalize on unique opportunities.

The growth of the country’s innovation and technology ecosystem has highlighted the need to focus on fundamental issues and discover innovative ideas. Shenasa, based on national issues and the capabilities of Pasargad Bank, is establishing businesses with large markets and high operational capabilities. It is focusing on identifying suitable opportunities and national needs in various industries, and on creating and managing new businesses. This effort is particularly focused on technical and business innovations.

This new strategy has been adopted with the aim of creating more value for stakeholders through the following mechanisms: utilizing the capacities and capabilities of Pasargad Bank to solve national problems in an innovative way; directing and creating synergy in the bank’s resources and Shenasa’s performance; entering larger and more diverse markets; and moving beyond the limitations of the traditional venture capital approach. A notable feature of this strategy is the creation of units with lower risk but on a larger scale. In the venture innovation approach, considering the considerations and requirements of business plans, Shenasa’s investment in these businesses will be a maximum of the equivalent of one million rials.

The difference between the venture innovation approach and venture capital is the focus on establishing businesses in Shenasa based on the real needs of the country. In fact, the initial idea and core of these businesses are formed and founded in the interaction of Shenasa with entrepreneurs.

Over a decade has passed since the emergence of the country’s innovation ecosystem and technology-driven businesses; therefore, the need for financing at higher stages and larger investment volumes has doubled.

In the current situation, many technology-driven and innovative companies and startups have the potential to enter higher stages of development or go public on the capital market. Therefore, through the conventional model of pre-IPO investment, it is possible to achieve profit and diversify Shenasa’s risk portfolio. The total investment for this purpose is considered to be the equivalent of 3 million US dollars.

In response to the identified needs to provide services to innovative teams and businesses at various levels, Shenasa has taken steps to expand its activities through specialized institutions. Some of these innovation institutions are already active, while others will be launched in the future based on the needs of the innovation ecosystem.

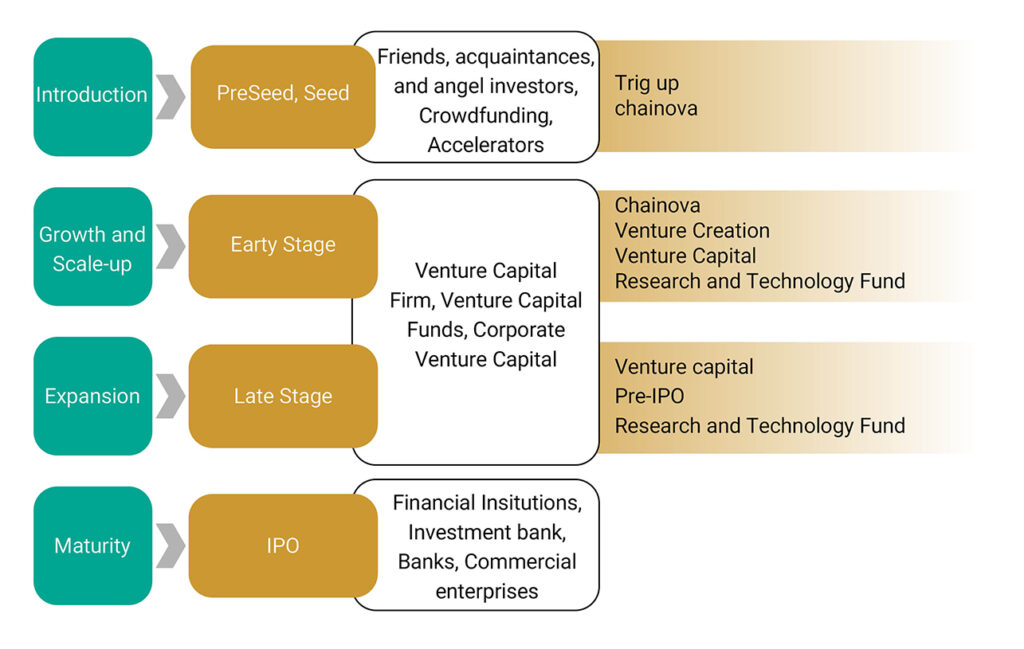

The primary objective of an accelerator is to foster the creation and growth of sustainable and competitive startups in both domestic and international markets. By providing access to a team of experienced professionals, specialized mentoring, and effective connections with a network of investors, influential individuals, and institutions in this field, accelerators aim to enhance the effectiveness of startups. To maximize market opportunities, startups that do not align with Shenasa’s investment stage and scale are referred to Trig-up for investment. The maximum investment for each business in this layer is 50 billion rials.

Chainova Startup Studio empowers entrepreneurs with innovative tools, its expertise in innovation, entrepreneurship, and blockchain technology to create startups that solve real-world problems and improve people’s lives globally. Chainova operates in the blockchain space and aims to attract top young talents in this industry to launch innovative ideas and create significant innovations in this field. The maximum investment for each startup project is 50 billion rials.

The Research and Technology Fund is established with the aim of creating opportunities for private sector participation and investment, as well as financing research, scientific, and technological activities, startups, technology-based companies, innovative companies, accelerators, and knowledge-based companies.

The role and necessity of these funds can be highlighted in the following areas: accelerating the financing process and reducing bureaucracy; facilitating the commercialization of technological achievements; creating opportunities for private sector participation and investment in technology and innovation; and compensating for the reluctance of traditional financial institutions to finance technology and innovation due to high risks.

As key players in financing knowledge-based and technology-based companies, research and technology funds, through their credit capacity, can play a significant role in attracting resources and helping to finance the identifiable investment portfolio, and also have a more active presence in the technology and innovation ecosystem.

It is expected that the role of the Research and Technology Fund in the value chain of will be to provide credit, act as a financial agent, and facilitate the activities of companies related to.

Additionally, this fund will have the ability to make investments such as investments in knowledge-based companies and project-based investments up to a maximum of 300 billion rials.

As depicted in the figure, Shenasa’s investment in projects will continue from the early stages of growth until shortly before the IPO, leveraging the capacities of Iran’s innovation ecosystem. Investments in the early layers of businesses are made through the establishment of specialized studios or the Shenasa acceleration arm, Trig-Up.

Geographic Focus

Shenasa prioritizes investing in businesses with Iranian founders. However, it’s not mandatory for the entire team to be based in Iran, and the market doesn’t have to be limited to Iran. Shenasa actively works to empower the businesses in its portfolio to enter international markets. Nevertheless, Shenasa emphasizes the dominance of Iranian identity in key individuals within the business or the primary operation of the startup being based in the country.

Investment volume

Shenasa’s venture capital investments start at $100,000 and can go up to $1 million. Investments in Trig-Up and Chinuva Startup Studio are capped at 50 billion rials.

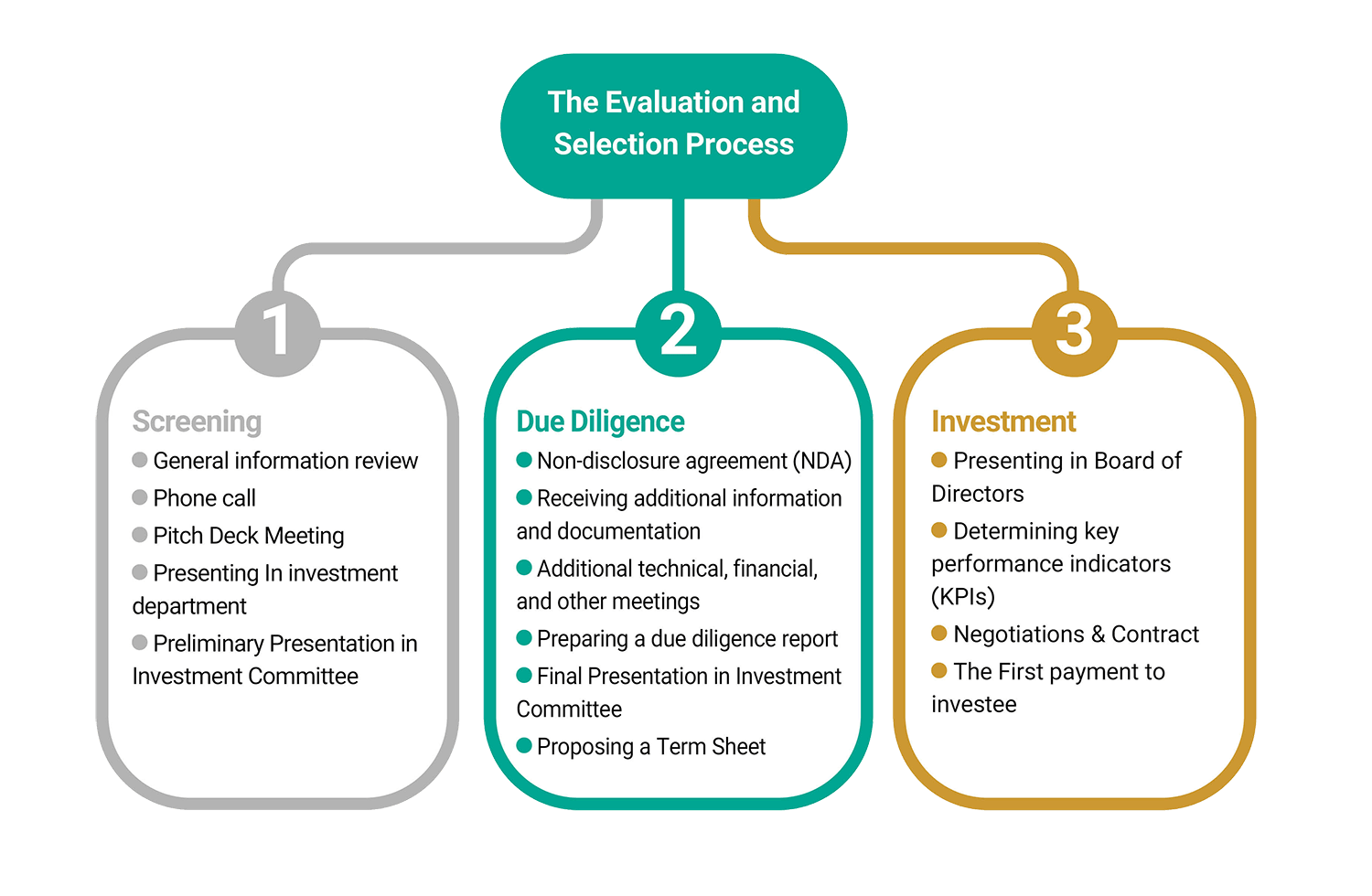

Given Shenasa’s focus on investing in startups at later stages, a thorough evaluation is conducted, including an assessment of the team, analysis of financial data, the company’s sales potential, and the evaluation of the business environment and market. To expedite matters and provide agile responses, in the evaluation process of projects introduced by investment partners, if the referrer confirms the business model and the investable team, it is possible to waive some stages to accelerate the evaluation process.

The image below shows the project evaluation process:

Venture capital is inherently high-risk. In Shenasa’s future plans, in addition to venture capital investments, large-scale, profitable projects are identified that go beyond the performance of a typical venture capitalist and reduce the overall portfolio risk. These projects serve as a risk management buffer within the overall investment portfolio.

The number and size of investments in large-scale projects and startups are managed with an 80-20 balance based on value creation. Specifically, 20% of the investment volume is allocated to 80% of the portfolio projects with higher risk, while 80% of the investments are made in projects with managed risk.

Furthermore, follow-on investments in portfolio companies, a successful strategy among global venture capital firms, offer the opportunity for both high-volume and lower-risk investments.

Given the current limitations of Iran’s innovation ecosystem, including significant restrictions on startup IPOs and international sanctions, exiting investments in the traditional form is quite challenging. To overcome this impasse, Shenasa has included the following initiatives and approaches in its plans:

Venture Creation Based on National Challenges and Group Capabilities: Addressing the challenge of innovative businesses entering the capital market by utilizing the network and assets of the Pasargad Financial Group.

Exiting Investments to Group Companies: Transferring investments to companies within the Pasargad Group.

Exiting Investments to Upstream Companies: Selling investments to larger companies in the industry.

Completing the Value Chain of Shenasa’s Portfolio Companies: Acquiring part or all of the shares of related companies in the country’s innovation ecosystem.

In line with its mission, Shenasa is committed to financing, investing in, and supporting innovative, diverse, and impactful startups with Iranian entrepreneurs who aim to create positive changes in industries, economy, environment, and global society.

Shenasa is fully aware that its decisions have environmental and social impacts and plays a catalytic role in creating a more diverse and inclusive technology ecosystem. Therefore, a responsible investment policy is an integral part of Shenasa’s mission to create long-term value for the Pasargad Financial Group and the companies in its portfolio.

Based on the lessons learned from its journey so far and the accumulation of knowledge from the processes of evaluating, investing in, and managing businesses, Shenasa takes the necessary actions to improve its policy and follows the environmental and social guidelines considered by the Pasargad Financial Group for sustainable development.